Look Carefully at the Home Itself

Here are four home attributes beyond the number of bedrooms and baths that you should have your eye on…

Home (building) quality: Very well-built homes are a rare find and typically worth every penny of their price. Don’t confuse them with so-so homes that just measure up to the city inspector’s threshold. Lesser quality homes will cost you more in upkeep and replacement as systems and components wear out. If you purchase a lesser quality home for less, the differential might just cover the added maintenance expense. But, if you purchase a fair quality home at the going rate of higher quality homes, you might likely be overpaying.

Deferred maintenance: Different than home quality, deferred maintenance includes the to-do list of items that need to be done to maintain a home’s integrity. A home that has been well maintained over its life typically is a better investment than one that hasn’t. The true cost of deferred maintenance often adds up to more than the cost of the repairs themselves. Don’t forget to factor in the reduced life span of other components—like replacement of damaged wood beneath peeling paint or mold remediation in a damp basement caused by a clogged foundation drain.

Setting: The saying “location, location, location” didn’t get its fame from out of nowhere. A home with an ideal setting on its lot and in the neighborhood—away from busy roads and utility poles/boxes, with adequate privacy, good topography, best positioned to capture views if available, and not adjacent to undesirable elements (poorly maintained homes, water towers or other unsightly public structures, high traffic facilities, etc.) will have more value than a less-ideally sited home. When deciding what to pay for a property it is critical that you evaluate these aspects and any others relevant to a specific neighborhood to determine the +/- effect on value.

Floor plan: How a home lives—flow from room to room, size of rooms, open/closed-off spaces, and below ground vs. above ground living are every bit as important as the total home square footage. You can change a lot of things about a home, but it is very difficult to change a bad floor plan. When you are deciding how high to make that multiple offer bid, consider factoring in the added value or take-away of the floor plan.

Beyond the Four Walls

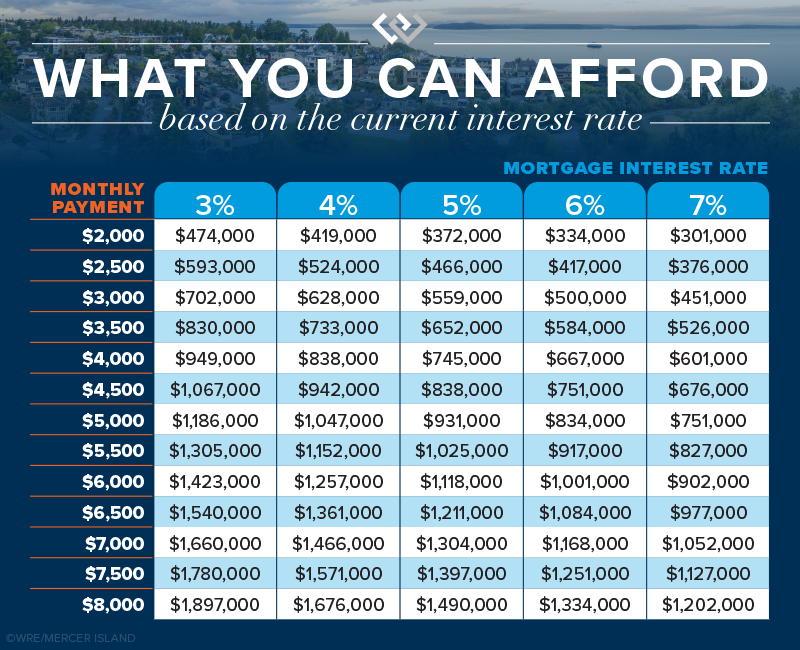

Interest Rates: In addition to being more selective about the home itself, it pays off to understand how interest rates impact your monthly housing cost. It’s a bigger deal than you might think. Every 1% increase in interest rate equates to roughly a 10% decrease in buying power. Said differently, a 10% drop in home sale price would be wiped out by a subtle 1% increase in mortgage interest rate. This means you can obtain a much more expensive home when rates are low, whereas higher rates get you less home—even though you still pay the same monthly payment.

If you have $5,000 a month to budget for a house payment (before taxes and insurance), you could purchase a $931,000 house at a 5% mortgage rate. If rates went up to 6%, the same monthly payment would only get you an $834,000 home. Your buying power diminishes considerably with each bump up in rates.

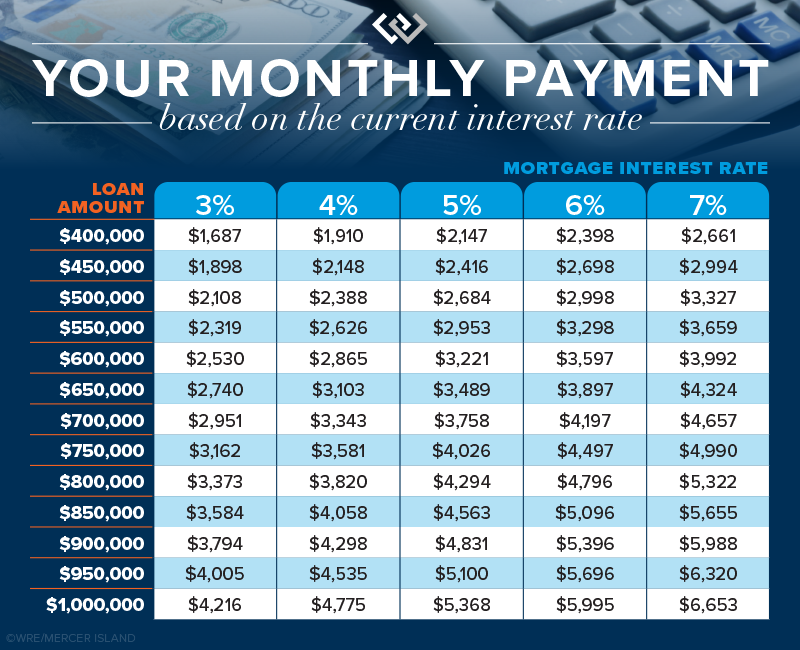

This second chart below shows how interest rates impact monthly payments. If you’re purchasing a $950,000 house at a 5% interest rate, you’ll be paying $596 less every month than if rates were 6%. That adds up quick…$7,152 in one year alone!

Job and Location Stability: Like nearly any investment vehicle, being able to buy and sell on your own time allows you take advantage of ideal market conditions or hold until a more favorable market returns. In an uncertain market, you should plan to be able to stay put for a minimum of 5-7 years if needed. If relocation or job loss is a distinct possibility, waiting to buy might avoid loss as a result of an untimely sale.

Homeownership Lifestyle: For many, homeownership represents a life accomplishment, independence, and financial security. For others, one more thing requiring maintenance and upkeep. Knowing where you stand (at this moment in time anyway) when it comes to evaluating the pros and cons of homeownership as a lifestyle choice is a better first step than an afterthought.

Final Thoughts

Want to know how you can best protect yourself in a changing real estate market? Reach out for help evaluating whether it would make financial sense to buy now or wait.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2022, Windermere Real Estate/Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link